Execute Bank transactions

Click. Click. Paid!

Make payment creation, payment approval and bank statement posting extremely easy and efficient.

Create Payments

Pick & send pre-approved items

2CLICK accounting have a built-in solution that picks up the approved items ready for payment execution. Simply choose the bank account you want your payments to be drawn from and click the items you want to pay. The system has imbedded secure bank connectivity solutions reaching all Danish bank and all European banks connected to the EBICS network.

By using our 2CA tool your will save time in the execution process of payments and the system makes sure you follow compliance rules connected to segregation of duties.

Approve Payments

Approve payments using double authentication

2CLICK accounting comes with both a role based advanced approval flow and an imbedded double authentication function. This allows you to pre-approve payments to avoide net-banking tool approval if that is your preference. Approval requires authentication through PIN-code and One-Time-Passwords connected to the users phone number.

By using our 2CA tool your will save time using a secure and lean process executing payments and handling you bank reconciliation.

Bank statement monitoring

Full transparency of all banking transactions

2CLICK accounting comes with a bank account statement monitor with automatic upload of daily bank account statements. The monitor gives you an overview of:

- All your bank statements

- Posting status

- Missing reconciled items

- Opening and closing balance

All in one overview!

By using our 2CA tool you will save time and effort when preforming your bank account monitoring and reconciliation.

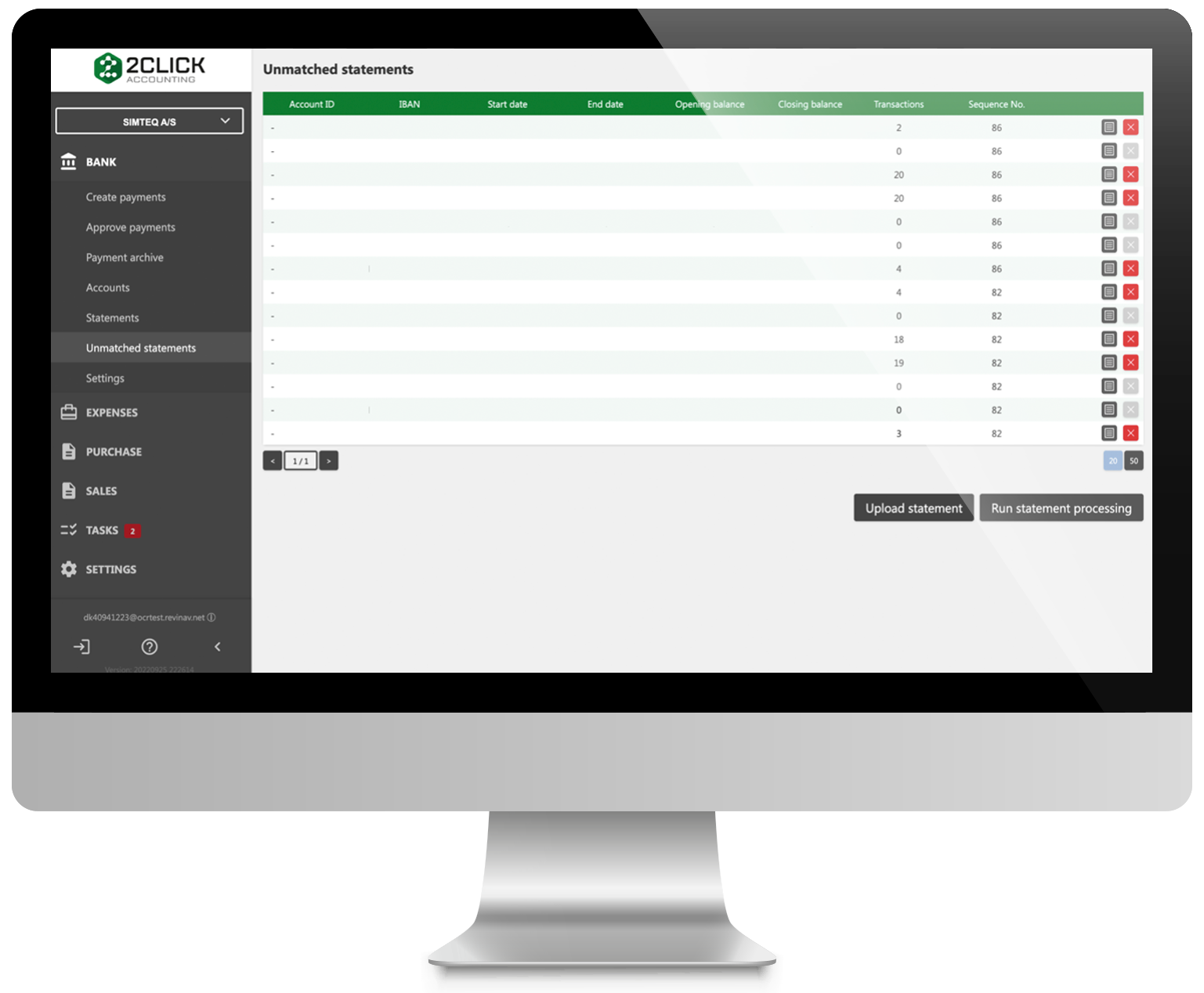

Bank statement reconsiliation

Simplify and automate your bank reconsiliation

2CLICK accounting comes with automatic bank reconciliation. You can pre-configure rule sets for auto matching using both reference fields, amount and date. You also have the possibility to add reference text and re-run the auto matching process.

Items not reconciled will appear in the overview and the system have a 2click solution for manual matching of accounts payable and receivable items.

By using our 2CA tool you will save time and effort when preforming bank account reconciliation utilizing the automation rules and the 2click manual handling of open items.

Automatic matching

The auto matching function is built on the principals of matching rules connection amounts, dates and references. The tool will use the bank data provided in the bank account statement to search in both accounts receivables and payables for open items. Un matched items can be edited (note to payee). Based on updates to note to payee you can re-run the auto matching process.

The system have customizable rule sets to handle both matching and pure postings e.g. posting of interests and fees. In addition, you can create tolerance levels. This means that the system can reconcile item where the amounts are not a 100% match e.g. exchange rate differences. The system will automatically assign the difference to the G/L account chosen by you.

2click manual matching

If the system, after the auto matching function, is not finding the right item to match you will see the open item in the overview. Simply click on the bank account statement where unmatched items appear. This will open a new screen where you will have an overview on the left side of open bank items, and a multiple selection screen to the right listing all non-matched items. Simply click on the two items that belong to each other and press post.

In the top of the screen, the system will always show the amount difference between the items marked on the left and right side. This makes it easy in situations where one bank items needs to match several items open in your accounting system.

Security

At 2Click Accounting we take security seriously. We keep your data safe and secure.

- We use SSL for secure user sessions

- Secure Microsoft AD for system logon

- Personal PIN codes and OTP for payments

- Secure and encrypted communication with banks

- Secure bank mandate setup

- Fraud warning on changes in supplier payment details

- Fraud warning on user changes of payment details

- Firewalls and VPN enabled

- Secure hosting on Microsoft AZURE

- Secure storage of bank encryption certificates

- Extensive backup policies

- System monitoring and warning logs

- Disaster recovery policies in place

- Strong internal access policies

- Extensive logging of user actions

Hosting

Scalability and secure hosting of business critical systems is of great importance.

To secure that systems are up and running much time as possible Microsoft Azure is the right choice for the task.

It is not possible to reach 100% uptime, as we need to do maintenance from time to time, but besides the mandatory maintenance, we aim to have services available to Our customers as much as possible.

By using Microsoft data centers for Our infrastructure setup, we secure top in class options for the services to be available as much as possible.

Structured deploy of updates, maintaining secure backup policies and having rapid disaster recovery processes in place are more streamlined with the use of Microsoft Azure hosting.

Mobile friendly

The use of mobile devices is a flexible and convenient solution for most business users.

2Click Accounting is made with mobile use in mind as we know it provides flexible options for business users to review purchases, approve purchases and look up historical data on the fly.

With the 2Click Accounting expense app, users get a flexible and fast way of submitting and posting their expense receipts, and business approvers can approve expense reports with ease, when they have time.

All aspects of the 2Click Accounting solutions are evaluated continuously to improve user experience and whenever a solution makes sence to perform on the fly, we always have a high focus on mobile friendlyness.

Sign up for 2Click Accounting and experience the mobile solutions.